Conversational AI Competitive Landscape

September 2024

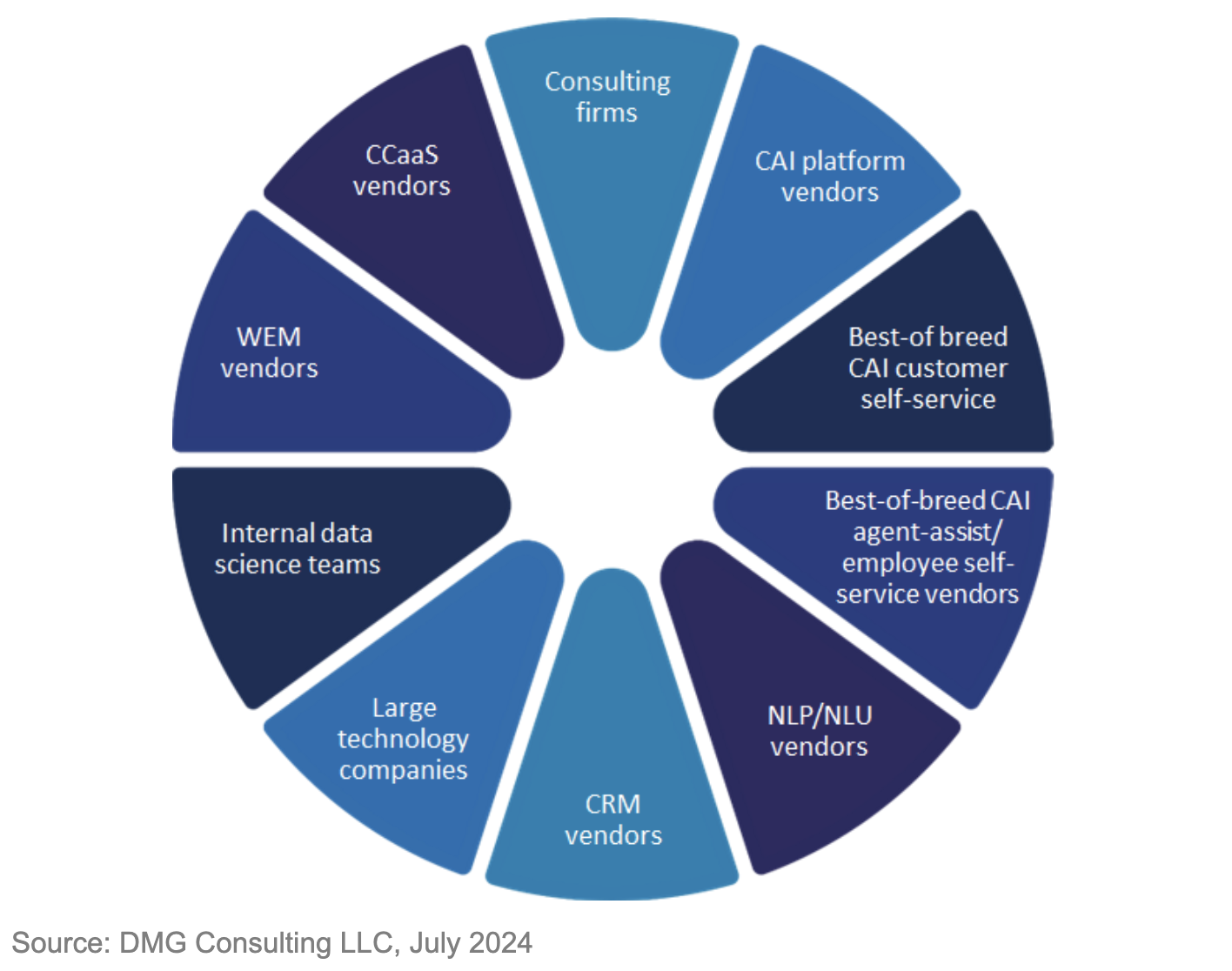

The conversational artificial intelligence (CAI) market is already crowded, with over 100 established platform and/or customer self-service competitors and more entering the sector. Each CAI offering is unique: some vendors’ platforms include both customer self-service and agent assist/augmentation applications; others concentrate solely on delivering customer self-service capabilities; and there are also best-of-breed providers focused on employee-facing applications. The CAI providers fall into the 10 categories shown in the figure below, although some vendors land in multiple categories. The vendors are competing aggressively to win sales, which gives those customers some leverage when negotiating a deal. However, the top competitors in this market are organizations’ internal development teams who believe they can provide these solutions by themselves.

2024 CAI Competitive Landscape

The 10 categories of competitors selling generative AI (GenAI)-enabled CAI solutions are described below. Each category includes a partial list of vendors:

- CAI platform vendors – provide a platform of CAI applications for customer self-service, agent assist/augmentation, and employee self-service. Vendors include [24]7.ai, Amelia, Artificial Solutions, Avaamo, Cognigy, Google CCAI, Kore.ai, Omilia, OneReach.ai, Openstream.ai, Rulai, Uniphore, and Yellow.ai.

- Best-of-breed CAI customer self-service vendors – deliver CAI solutions to intelligently automate the handling of customer inquiries and interactions. Vendors include IntelePeer.

- Best-of-breed CAI agent-assist/employee self-service vendors – deliver applications to augment agent performance and automate employee self-service functions with internal departments like HR, help desk, workforce management (WFM)/scheduling, etc. Vendors include NICE.

- Natural language processing/understanding (NLP/NLU) vendors – providers who initially delivered speech-related applications and have expanded their NLP/NLU-based offerings to include CAI solutions. Includes Inbenta, Interactions, Omilia, and SESTEK.

- Customer relationship management (CRM) vendors – providers with integrated CAI applications; they use the customer data and knowledge assets contained in their CRM platform as a data source. Includes Microsoft Dynamics, Oracle, Salesforce, and Zendesk.

- Large technology companies – global technology companies that have expanded their offerings to include CAI applications. Includes Amazon, Google, IBM, Microsoft, Oracle, Salesforce, and SAP.

- Internal data science teams – company resources that build their own CAI applications to provide customer self-service capabilities or employee assistance.

- Workforce engagement management (WEM) vendors – providers who offer CAI solutions to complement their suite of WEM applications. Includes Five9, Genesys, and Verint.

- Contact center as a service (CCaaS) vendors – providers of cloud-based omnichannel contact center infrastructure who offer CAI solutions. Includes Cisco, Five9, Genesys, Google, Odigo, Puzzel, Sinch, and UJET.

- Consulting firms – companies that develop CAI solutions combining proprietary assets, methods, and tools with those from their partner ecosystems to help enterprise clients improve their customer-facing self-service environments and augment agent performance. Includes Accenture, Capgemini, Deloitte, and IBM.

Today’s CAI vendors primarily focus on the customer self-service market, although many have expanded their platforms to include employee-facing applications. DMG expects to see significant changes in the CAI competitive landscape and increased innovation in the offerings as this market matures over the next 12 – 24 months. DMG just released a new industry report, Conversational AI Solutions for the Enterprise, that analyzes the CAI market and provides an in-depth analysis of five high-value vendors with unique offerings: Cognigy, IntelePeer, Kore.ai, SESTEK, and Verint Systems. The Report is intended to help enterprise, contact center, customer service, and IT leaders select the best solution for their operating environment. The Report includes 170+ RFI/RFP questions and vetted vendor answers about functionality, security, compliance, business intelligence, and more. It also provides pricing, use cases, benefits, implementation best practices, as well as a customer satisfaction study measuring end-user satisfaction with the vendors and their products. Please reach out to us at info@dmgconsult.com if you’re looking for information about the vendors or need help selecting a GenAI-enabled self-service or agent augmentation solution.